Income tax conditions out of Senate Cash form of the newest funds costs

Content

Those people price decrease have been set to sunset at the end of 2025, nevertheless the You to Big Beautiful Expenses Work, while the scale is actually generally named, makes them permanent. Because the elder income tax publisher during the Kiplinger.com, Kelley Roentgen. Taylor simplifies state and federal tax suggestions, reports, and improvements to assist empower members. Kelley has more than two decades https://happy-gambler.com/coyote-cash/real-money/ of expertise informing to your and you can level training, rules, finance, and tax while the a business attorneys and you will organization blogger. However, analysis strongly recommend the fresh deduction would be best to those which have enough nonexempt earnings when deciding to take benefit of it. Less than both Home and you may Senate brands of the expenses, withdrawals you may initiate from the years 18, where part account holders can be tap to half the money to own degree expenses or history, the brand new downpayment for the a primary family otherwise because the investment so you can initiate a company.

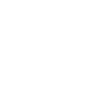

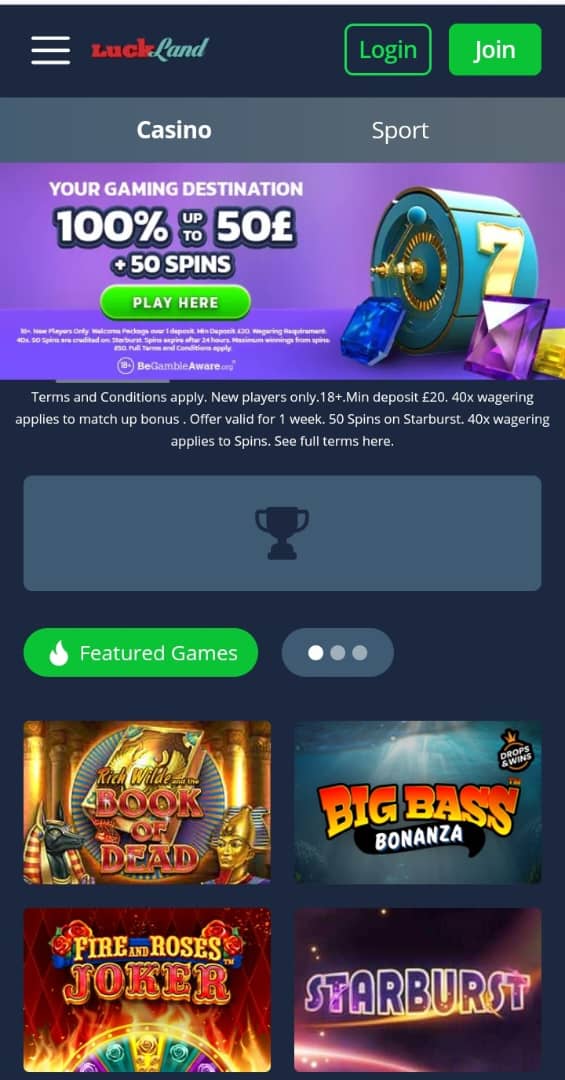

Most people are lured by Large Break thanks to their design and you may surroundings. The of several virtues have lead to the fact that how of numerous its fans keeps growing every day. Many individuals point out that making a profit using this type of device is not tough. You only need to submit a certain type, showing personal information in it, and you may make sure the brand new procedure thru Email. Our home adaptation perform reinstate the brand new Area 163(j) EBITDA limit to own income tax many years birth just after December 30, 2024 as a result of January step one, 2030.

Is actually annuities a secure money that it August? 5 things to understand now

After the Senate introduced their adaptation to the Monday, our house Republicans to your Thursday voted to help you accept the newest multi-trillion-money residential policy regulations and you can publish it so you can Trump’s desk to own signature. The brand new elder “bonus” deduction might possibly be in effect from 2025 as a result of 2028, with regards to the offer. Certain Us citizens decades 65 and over try poised observe extra income tax save lower than Republicans’ “huge stunning” costs. Below are definitions of brand new provisions in the You to definitely Big Breathtaking Statement Operate, finalized to the legislation for the July cuatro, 2025, since the Societal Rules , that go to the feeling for 2025. It doesn’t matter how the balance transform, it’s clear one taxation change will remain a central thing while in the 2025.

Real Taxation Price

To your July 4, President Trump closed for the rules usually the one Big Gorgeous Bill Work (Bill), that was approved by the Senate and you may House prior to from the week. The brand new 870 webpage-expenses talks about just about any field of your American savings, and you may stretches many of the taxpayer-friendly provisions of your Tax Cuts and you may Work Act (TCJA), passed inside Chairman Trump’s very first label. Below is actually the report on the alterations that will connect with enterprises and other people. The new attorney in the Stinson will be ready to answer your concerns and offer recommendations on just how these transform usually apply at your. Qualified Charitable Withdrawals (QCDs) of IRAs remain a powerful equipment to give right to charity as opposed to expanding taxable money.

Just how Trump accounts performs

“The only, larger, stunning costs not only brings long lasting tax incisions and you will large paychecks, nevertheless protects a historical income tax split to possess elderly people for the Personal Protection,” White Family representative Anna Kelly said. “This really is other hope produced, hope kept to your the elderly who are entitled to much-needed income tax rescue after few years away from distress lower than Bidenflation.” Beneath the Family scale, meanwhile, simply people with annual income out of $160,one hundred thousand otherwise smaller create qualify for the fresh tipping income tax crack, as the Senate adaptation do stage out advantages for those whose earnings is higher than $150,100000 or lovers whoever money exceeds $three hundred,100000. The fresh Better business bureau do forever improve the exemption to $15 million from 2026, for the number listed to own rising cost of living inside then decades. Starting in 2026, the brand new phaseout endurance increases to help you $150,100000 to own single filers and you will $300,100000 for mutual filers. Some business terms and you may increases to personal provisions are available in the initial 50 percent of the brand new budget windows but sundown by second 50 percent of, therefore from the 2034, the increase within the after-taxation earnings was smaller in the dos.step three percent typically.

The newest AMT different phaseout price was also improved from one fourth below previous legislation so you can fifty percent of 2026 ahead, meaning the brand new different are quicker twice as fast after income is higher than the new tolerance. I estimate the fresh income tax rules increases long-focus on GDP because of the step one.dos per cent while increasing the brand new shortage because of the $step three trillion along the second ten years when factoring in the using incisions and monetary growth. Depending on the bill, specific Western the elderly that are 65 yrs . old and you may more than often end up being welcome a tax deduction of up to $six,100000 for each and every qualified taxpayer. Here’s what things to find out about the fresh tax deduction for qualified older taxpayers. “It really depends on your local area to the income shipping,” Gleckman said, with middle-earnings taxpayers positioned to profit most. The brand new 2017 Tax Incisions and you will Operate Work (TCJA) lowered five of your own seven personal income tax supports, like the best rate, and this decrease from 39.six percent so you can 37 percent.

People is win as much as £10,100000 within the eachspin, and the bonus bullet offers an additional chance to win higher sums of money. The big Break incentive feature honors people revolves once they home about three coordinating icons anyplace for the reels. Landing five such signs results in a jackpot payment worth upwards to £twenty five,100. One of other qualifiers, the fresh grant-giving establishment need finance honours to own qualified college students inside condition. Pupils which have family members earnings not more than 300% of its area’s average revenues will be qualified to receive the new grants. For just one, the brand new laws expands entry to Pell Offers, a kind of government help open to lower-money families, for students signed up for quick-identity, workforce-concentrated training applications.

- That means an individual filer more than 65 you will deduct as much as $23,750(previously $16,550).

- But with it extended deduction, it may be worth changing one to series.

- “The only, large, stunning expenses not simply brings permanent taxation cuts and you may larger paychecks, nonetheless it secures a historic taxation crack for elderly people for the Public Defense,” Light House spokesperson Anna Kelly said.

- We don’t expect to have any college students (otherwise grandchildren) created ranging from 2025 and 2028.

- The kid may use the money to own university, a primary family, childbearing, otherwise particular other expenditures, nevertheless they get face an excellent ten% punishment to the unapproved distributions prior to they come to many years 59½.

- However, “provisions one to stay in the Home and Senate text, we want to expect them to getting laws, and this supply fits one to conditions.”

Zero tax to the Public Shelter advantages, otherwise $4,000 elder ‘bonus’: How they evaluate

For the July 4, Chairman Trump closed to the rules the brand new broad-ranging finances and you may goverment tax bill known as the One to Big Stunning Statement Operate (OBBBA). It intentions to slow down the deduction smaller for higher income – phasing it during the 6 % instead of 4 %, like the House’s adaptation, Alex Durante, senior economist during the Tax Basis, advised CNBC. The new senior “bonus” – as it’s been named by the House away from Representatives – has been considering instead of Trump’s venture vow to slice fees to your Public Security pros. Seniors can get income tax getaways in the Senate’s form of Donald Trump’s ‘One Big Breathtaking Costs Act’. One that’s getting floated up to Capitol Hill is always to build the fresh 100 % added bonus depreciation permanent. Thus, associations perform calculate the new pupil-modified endowment proportion instead mention of college students expose to your F, J otherwise Meters visas, or undocumented people.

The fresh tax split create apply at experts just who generally discover cash info advertised on their employer to have payroll taxation withholdings. It doesn’t apply to taxpayers whose income is higher than $150,100000, otherwise $3 hundred,one hundred thousand to possess mutual filers. The newest GOP’s marquee laws will even enact strong paying slices in order to societal safety net programs such as Medicaid and you can dinner stamp benefits, end taxation credit linked with brush times and you can redesign federal student loans. Now that the newest Senate and you can Family have one another introduced their brands of your tax and you may using statement, it’s up to President Donald Trump in order to indication it to the rules, as well as an alternative short-term deduction — called a senior “bonus” in the legislative text. The present day $10,100000 limit on the Sodium deduction will be raised so you can $40,000 to possess 2025, which have an excellent phaseout to own taxpayers making over $five hundred,100 ($20,100 cap, $250,000 phase away to own partnered submitting separate). The bill do restore one hundred% first-seasons extra decline to own eligible assets obtained and you may placed in provider ranging from January 19, 2025, and December 31, 2029.

Inside tremendously digital community, research protection has been one of the most critical demands against fund and you will bookkeeping advantages today. Stand up-to-date with simple guidance to help you decrease such threats and you may improve your protection present. The new Senate Money Committee type of the balance could have imposed a step three.5% tax on the for example transmits.

Under current rules, the brand new R&D borrowing allows businesses to write from being qualified R&D expenditures—nonetheless they have to amortize those individuals will cost you more 5 years. The new projected ratio away from debt to GDP perform raise away from a good standard level of 162.step three % within 35 years in order to 174.step three % to the a conventional foundation. Just after factoring from the revenue viewpoints out of monetary growth, debt in order to GDP create rise 5.7 commission items to 168.0 percent by the you to 2059 address year. In the an excellent 9.3% interest rate — normal of individuals having subprime fico scores — the typical the newest automobile consumer will save you in the $dos,2 hundred to your fees more than number of years, Smoke told you.

The brand new TCJA’s expiring personal specifications and you can organization items like completely extra decline, home-based R&D expensing, and you can an even more ample focus restriction are made long lasting. The newest expansions for the standard deduction and you may boy income tax credit, and adjustments for the solution minimum income tax (AMT) also are permanent. 10 years later on, an additional tax level greeting around 85% out of advantageous assets to become taxed during the federal speed whenever provisional money exceeded $34,100000 and you will $forty two,000 for those and you may lovers filing as you, respectively. Which provision manage limit the usefulness away from state passthrough entity taxation (PTETs) while we are avoiding the new Salt cap.